|

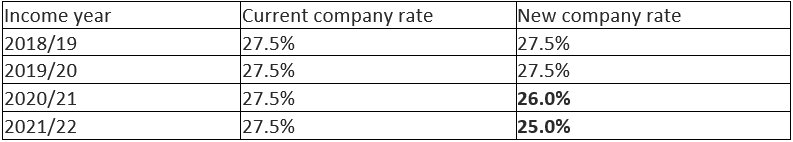

Companies with aggregated turnover under $50m may pay a lower rate of tax from the 2021/22 income year. This tax rate has been brought forward five years from current laws.This change in tax rate for base rate entities will have a consequential change in the imputation rates as well.

The change to the company rates for base rate entities is as follows:

1 Comment

With the end of financial year approaching, we remind and assist all taxpayers to implement adequate tax planning strategies by providing the following checklist.

For Business Owners:

From 1 July 2018, purchasers of new residential premises or subdivisions of potential residential land will need to pay the GST component of the purchase price directly to us on or before settlement.

The amount of GST will not change. This does not affect the sales of existing residential properties or the sales of new or existing commercial properties. For property transactions, purchasers will need to:

Settlements will not be conditional on the payment of GST to us. Property developers will need to give written notification to the purchasers when they need to withhold. The liability for the GST remains with the property developer, and there are no changes to how property developers lodge their business activity statements. Article for further reading: Getting market value right for taxation purposes Resource: Changes to GST payments at settlement |

Archives

August 2020

Categories

All

|

62 Sanders Street UPPER MOUNT GRAVATT QLD 4122

|

Contact Us |