|

September 2017 Phone scam – fake debts Scammers are contacting people to say they have a tax debt and that they must pay immediately:

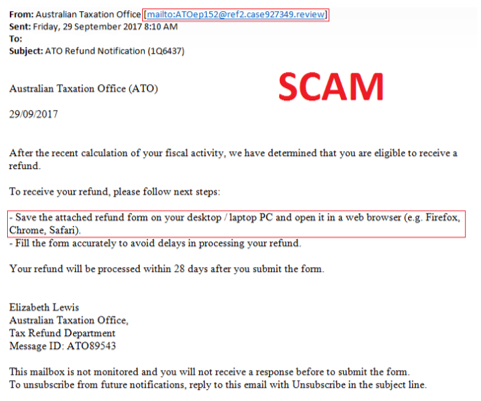

September 2017 Email scam - refund Scammers are emailing people to tell them to claim their tax refund online. The email:

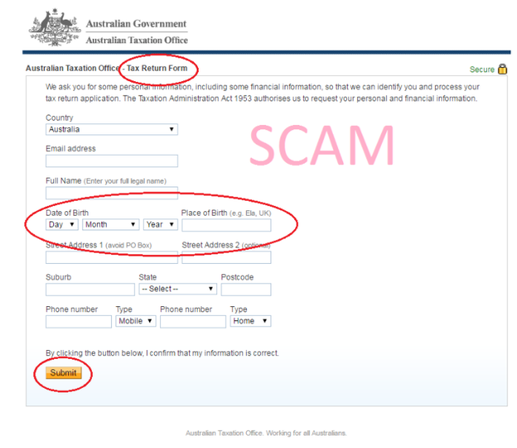

August 2017 Scam - Tax return form Scammers are circulating an online form claiming to be the ATO's online Tax return form. If you come across a form such as this, it is a scam. This form:

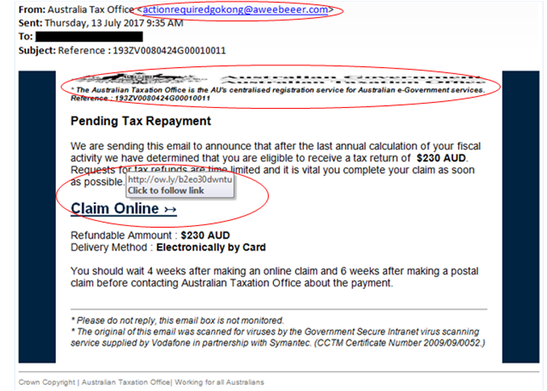

July 2017 Email scam - tax repayment Scammers are emailing people to tell them that they can claim a tax repayment or tax return online. This email:

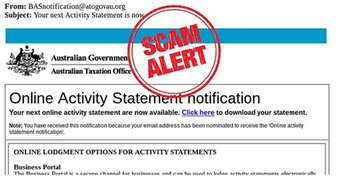

March 2017 Email Scam - online activity statement Scammers are emailing people to tell them that they can download their online activity statement. This scam email:

Source: Scam alerts

1 Comment

To improve your online safety:

Source: Stay smart online to avoid cybercrime  The Department is currently receiving a high volume of queries around how ITOs apply in the context of visa grant periods and the interpretation of caveats. The frequently asked questions below are designed to address commonly asked questions and define key terms that agents have raised questions about – noting that the subclass 457 form currently asks whether the nominee is an intra-company transfer, but policy guidelines around ITOs refer to the term intra-corporate transferee, and note that certain occupations are considered 'Executives and Senior Managers' for the purposes of the program. What is the difference between an intra-corporate transferee and an intra-company transfer? The term intra-company transfer simply refers to an employee that is transferring between two associated entities. An intra-corporate transferee is a term used in international trade agreements to refer to an intra-company transfer to which an international trade obligation applies. Obligations vary by trade agreement, this includes aspects relating to visa duration and labour market testing, and might be restricted to particular occupations, such as Executive and Senior Managers (see list of these occupations on our website). For example, an employee transferring from their parent company in China to an associated entity in Australia is an intra-company transfer. This transfer is also described in a trade agreement (ChAFTA) and necessitates a number of conditions, including stipulations on visa duration and labour market testing. As a result, the employee in this scenario is an 'intra-corporate transferee'. What is the difference between an independent executive and an intra-corporate transferee? Independent executives and intra-corporate transferees are treated as separate categories of entrant in trade agreements and are entitled to different visa treatments. The difference is that unlike intra-corporate transferees, independent executives will be managing a business in Australia that might not exist in Australia yet. That is, they are coming to Australia to establish a new branch of their company. Important:

If the nominee is NOT from China, Singapore or Thailand, a visa period of up to 4 years for STSOL occupations is only available if:

Yes – but only if the nominee is from Singapore and an intra-corporate transferee. What about Hong Kong (HK)? Passport holders from Hong Kong (HK) are only eligible for a visa period of up to four years for occupations on the STSOL where they are an intra-corporate transferee nominated as an Executive or Senior Manager. For a four year visa to be available, does the nominee have to continue to work for the overseas business? No – they can still be an intra-corporate transferee if they are working for a sponsor in Australia, who is an associated entity of the overseas business. Can you explain how ITOs are relevant in the context of caveats? Some caveats do not apply where the nominated position involves an intra-corporate transfer to which an ITO applies. For example, some caveats which require the nominated base salary to be at least a certain amount do not apply where the position involves an intra-corporate transfer to which an ITO applies. This effectively means that a caveat which references an ITO does not apply if the nominee is:

Source: Skilled Visa E-news September 2017 |

Archives

August 2020

Categories

All

|

62 Sanders Street UPPER MOUNT GRAVATT QLD 4122

|

Contact Us |