|

From 1 July 2018, if you have 20 or more employees, you'll need to use Single Touch Payroll-enabled software to report your tax and super information to us.

You'll need to report the following on or before your payroll pay day:

To find out if you need to report through Single Touch Payroll, you'll need to do a headcount of the number of employees you have on 1 April 2018. You can also ask a third party - like a payroll service provider or tax professional - to report for you if they use Single Touch Payroll-enabled software. What's changing? You may not need to provide payment summaries to your employees at the end of financial year when you report through Single Touch Payroll.

What you need to do

For more information, please check out the link below: https://www.ato.gov.au/misc/communications/74793.500835M.html

0 Comments

September 2017 Phone scam – fake debts Scammers are contacting people to say they have a tax debt and that they must pay immediately:

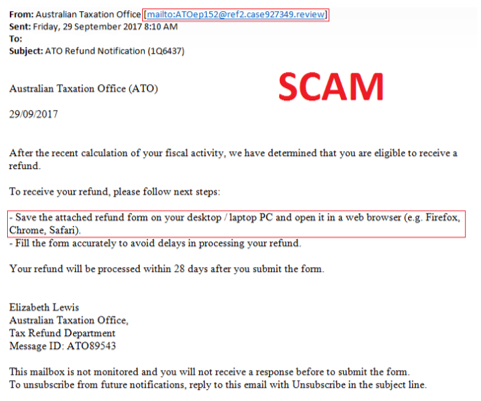

September 2017 Email scam - refund Scammers are emailing people to tell them to claim their tax refund online. The email:

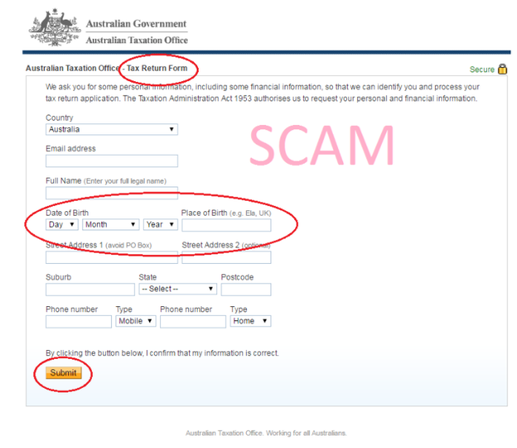

August 2017 Scam - Tax return form Scammers are circulating an online form claiming to be the ATO's online Tax return form. If you come across a form such as this, it is a scam. This form:

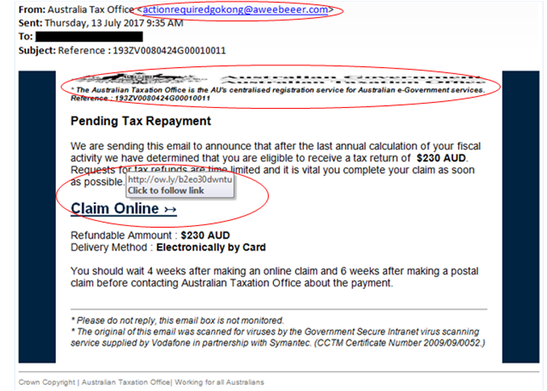

July 2017 Email scam - tax repayment Scammers are emailing people to tell them that they can claim a tax repayment or tax return online. This email:

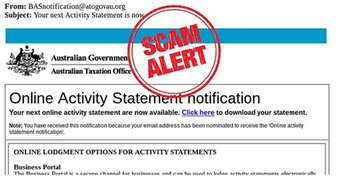

March 2017 Email Scam - online activity statement Scammers are emailing people to tell them that they can download their online activity statement. This scam email:

Source: Scam alerts To improve your online safety:

Source: Stay smart online to avoid cybercrime |

Archives

August 2020

Categories

All

|

62 Sanders Street UPPER MOUNT GRAVATT QLD 4122

|

Contact Us |